- Home

- Blog

Popular & Trending

Freehold vs. leasehold in Singapore: Which is better? Understand the differences, pros and cons of each property tenure to make informed decisions.

Wondering if mortgage rates in Singapore will drop in 2025? While experts predict a gradual decline, the timeline remains uncertain. With fixed rates currently lower than floating rates, is now the right time to lock in a loan? This article breaks down interest rate trends, expert forecasts, and the best refinancing strategies for homeowners. Read on to make the smartest mortgage decision in 2025!

Looking for the best home loan in Singapore? This guide compares fixed vs floating rate home loans, breaking down their pros and cons, who they are best suited for, and how to choose the right mortgage in 2025. Whether you're buying a new launch condo or refinancing, find out which loan type will save you the most money. Read now to make an informed decision!

Article Categories

Our Articles

These days, there are many reasons why you may not want to meet someone face-to-face. Find out how you can apply for home loans in Singapore without ever needing to meet someone!

Our CEO, David Baey, shares how his time as a banker led him to discover the mortgage broker career. Read about his win-win-win-win strategy for the home loan industry in Singapore!

Find out why mortgage interest rates are skyrocketing in 2018 and what you can do to make sure your monthly instalment payment does not increase as well.

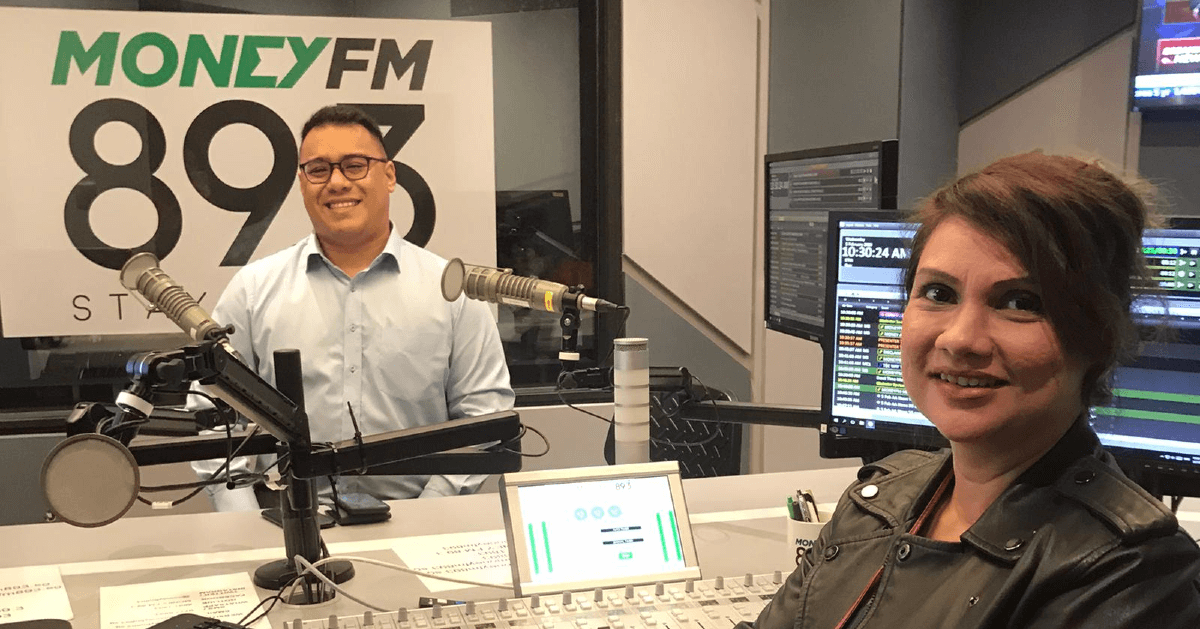

On 5 February 2020, Mortgage Master CEO David Baey was interviewed by Michelle Martin on Money FM 89.3 about choosing the best mortgage loan. Here is the interview transcript.

The mortgage market is like a train threatening to go off the rails. Left to their own devices, homeowners have to spend hours researching through multiple diverse home loan packages offered by several banks in Singapore, or they risk choosing poorly. Mortgage brokers are the solution.

Confused about mortgage loans and what they mean in Singapore? What is the meaning of fixed rate home loans or SIBOR? We help you make sense of home loan rates.

Ready to buy a house in Singapore? Don't forget to consider three things: whether to get an HDB loan or a bank loan, whether you can afford your downpayment, and if you have the ability to pay your home loan monthly instalments!

When one bank in Singapore announced they were raising their interest rate floor, the backlash was swift. But what is an interest rate floor and are banks allowed to raise it? I mean... it's supposed to be a FLOOR, right?

Are you buying an HDB flat in Singapore? Then you'll have to confront a perennial question. Is an HDB loan or bank loan better? What about for BTO? We weigh the pros and cons of each decision.

Should you choose a SIBOR rate for your housing loan in Singapore? What is the difference between 3 month SIBOR and 1 month SIBOR? Learn more about the Singapore Interbank Offered Rate and why it is so crucial to your mortgage.