16 banks are offering a wide variety of home loan packages with competing interest rates.

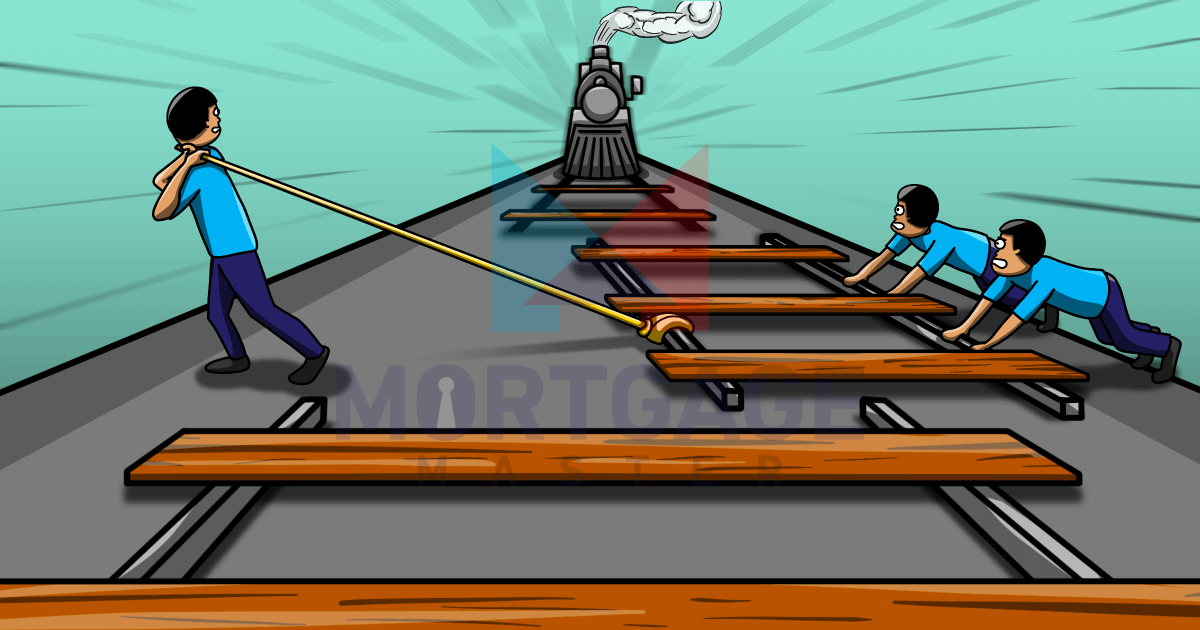

Homeowners in Singapore are expected to spend hours of your precious time doing research to find what’s best. Most of you can’t afford the 10 to 12 hours!

You end up choosing a bank that you’re familiar with. The mortgage market is making you miss out on the best rate, which could have saved you thousands of dollars every year!

On the other hand, banks that are offering the best rate but are less well-known find themselves unable to compete since there is no level playing field.

The solution to this broken mortgage market is mortgage brokers.

Homeowners in Singapore face a lot of decisions in today’s mortgage market

Mortgage brokers help homeowners like you save time and money by finding the best deal.

Those buying your first home will need to make several major decisions for the first time in your lives in a very short period. This can be very stressful, and you may turn to the wrong people for guidance.

Mortgage brokers are independent advisors who have access to the home loan packages of all the banks in Singapore. They can speak authoritatively when comparing HDB loans and bank loans, fixed rates and floating rates, or SIBOR and board rates.

The best mortgage brokers can personalise their advice and determine the most ideal home loan package for your unique situation. Mortgage brokers look at your outstanding loan amount, the length of your loan tenure, and your current life stage. The best mortgage brokers can inform their customers which bank has the best home loan package for you.

Most importantly, the best home loan package might not be the one with the lowest interest rate!

The best mortgage brokers have the homeowner’s long-term welfare in mind

Mortgage brokers thrive on a lifelong relationship with the customer built on trust and mutual benefit.

Throughout a homeowner’s loan tenure, there will be times where it is financially savvy to consider refinancing your home loan. A mortgage broker can help customers like you get a lower interest rate and save money in the long run.

The mortgage broker is also intimately aware of all the fine print of each home loan transaction. The best mortgage brokers have information about all the fees and charges at their fingertips and can calculate whether it is a good time for you to refinance your home loan.

The value of a trusted relationship between the mortgage broker and their customers cannot be underestimated. When making some of the biggest financial decisions of your life, you should choose someone who puts your needs first.

Best of all, mortgage brokers provide this service to homeowners for free

Mortgage brokers help you save time and money by providing a comparison service. Even better, they also do not charge you a single cent for their time! This is because each bank pays a standard commission to the mortgage brokers for each successful home loan application.

Mortgage brokers are therefore able to remain independent. There is no advantage to providing homeowners with misleading information. There is no advantage to recommending any bank’s home loan package that is not the best. Once your trust is broken, it is the mortgage broker that will have lost a lifelong customer.

Mortgage brokers are part of the mortgage market ecosystem

Look at the relationship between the bank, mortgage broker and homeowner. It is a value-adding ecosystem. Mortgage brokers challenge banks to offer more competitive home loan packages. This benefits the homeowner.

In return, mortgage brokers ensure that banks always have a level playing field to compete in. Only the best home loan packages in the market will attract homeowners, after all.

There are few other industries where everyone can benefit from the same ecosystem. It is in everyone’s interest to produce the most beneficial solution for the other parties. In this way, we can fix the broken mortgage market in Singapore.

Are you buying a new property or has your lock-in period ended on your existing loan? Give our mortgage brokers at Mortgage Master a call at 6974 7673, WhatsApp us or fill up our enquiry form.