It's a headline only property sellers love to see: "HDB resale prices rise for 31st straight month". Even with a marginal 0.1% dip in February this year, prices have continued to rise for the 5 months after that. The sellers market continues to endure against all odds, even as GDP growth continues to shrink this year.

But can we expect HDB resale prices to drop in 2024? One way we can make an educated guess is by looking at the HDB Resale Price Index.

What is the HDB Resale Price Index?

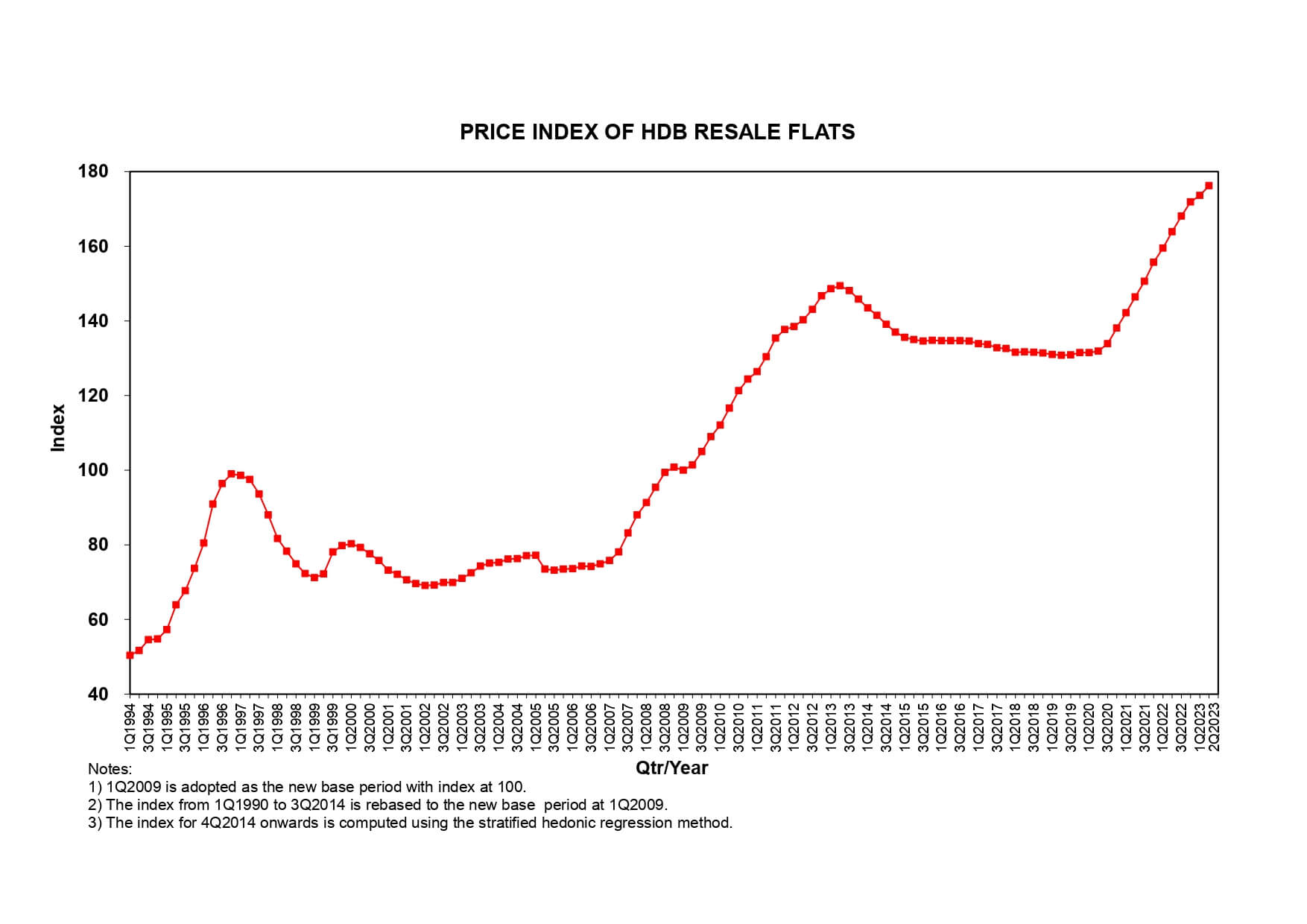

The HDB Resale Price Index is an indicator of overall price movement of public housing. It is calculated using resale transactions registered each quarter across towns and flat types.

Source: HDB

Source: HDB

The current base period is the 1st quarter of 2009 - which means 1Q2009 has an RPI of 100. The HDB Resale Price Index for the 2nd quarter of 2023 is 176.2. That means prices of HDB resale flats today are over 76% more than what they were in 2009!

This is the highest price index we've ever seen, beating the previous records set last year. Before this current streak, the highest HDB RPI was 149.4 in 2Q2013.

We can also see that the last time the Resale Price Index rose at this rate, it was over a period of 8 years between 2005 and 2013. Back then, the government had tried to introduce various cooling measures from 2010 onwards, but it was only upon introducing MSR and TDSR in 2013 that finally caused the HDB Resale Price Index to drop that year.

The 2022 cooling measures appear to be effective

The cooling measures that came into effect at the end of 2022, appear to have slowed down the pace of resale prices.

The latest Resale Price Index of 176.2 represents a 1.5% increase quarter-on-quarter. In Q1 2023, the quarter-on-quarter increase was even lower, at 1.0%. These numbers are significant compared to previous years, where RPI was increasing at a rate of as much as 3.4% (back in Q4 2021)

There have been further cooling measures this year, with increases in ABSD. These have been much more effective in slowing down the growth in private property prices, as evidenced by the Residential Property Price Index.

source: tradingeconomics.com

This is because the main group of buyers affected by this year's increases in ABSD are those looking to buy investment property, with the biggest increases being levied on foreigners and entities. Historically, ABSD on its own is not a very effective method of cooling HDB resale prices.

Why are HDB resale prices so resilient?

Even in the worst economic situation, HDB flats tend to be the least affected. With most units being owner-occupied, as opposed to being investment properties, most sellers will either keep their units or downgrade to another HDB flat.

In fact, in a recession, demand for HDB flats may grow as homeowners looking to sell their condos will likely buy an HDB flat from the ever-present resale market.

What does this mean for HDB resale prices in 2024?

All this seems to suggest that, barring further cooling measures, we can still expect HDB resale prices to continue to grow till next year, despite the current slowdown in growth.

Are you looking to buy an HDB resale flat despite the high prices?

While it might not be ideal to go house-hunting at this time, for some of us, it is unavoidable. Perhaps we want to secure a location close to our child's preferred educational institutions. Maybe there's a need to move closer to our aging parents.

Whatever your reasons, we recommend you start your homebuying journey by getting a HFE and/or an approval-in-principle from a bank. This is an indication of how much you can borrow, so that have a better idea of how much cash you need for the downpayment. A good mortgage consultant will be able to assist you with this step.

At Mortgage Master, we know the latest home loan packages in the market and can sometimes even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.