SOUND THE ALARM. HDB HAS RELEASED ITS BTO PRICES.

If you haven’t applied yet, I’m sure your partner has been hounding you so I won’t need to do it.

For singles, here is your cue to do so.

Given that this is one of the most anticipated launches (from the sheer amount of 'is BTO out yet?' in the telegram group),

I’m sure that most of you would have already done your own research via …

- Reading BTO guides from other websites

- Asking friends who have already BTO-ed for tips

- Joining communities to discuss about BTO-related topics

So, I’m not going to bore you with yet ANOTHER recap of the basics or ‘everything you should know’.

By the time this gets released, I think it’ll be a bit too late to be learning the basics anyway.

Instead, if you give me 35 seconds … let me just talk about ONE thing most people forget in the rush of BTO bidding.

It’s a fact that many Singaporeans consider their BTOs a ‘Home’.

And while homes are sacred, snug sanctuaries where we seek shelter and safety from the sinister space that we call “outside”, it doesn’t mean we can’t search for new homes when the opportunity arises.

Just because it’s your first house, doesn’t mean you have to follow Rosé and treat it As if it’s your last.

What is MOP?

The Minimum Occupation Period (MOP) refers to the … well ... minimum period that one has to occupy the house.

While this article is focusing on BTOs, the MOP applies to all other Government subsidised houses such as resales, DBSS (those discontinued, more atas HDBs) and ECs.

How long is MOP?

MOP for BTOs, resales and DBSS are 5 years, which is to say,

-

From the day you receive the keys to your house, you have to reside in that house for at least 5 years before you can put that property back on the market.

-

You can rent it out, but you have to occupy at least 1 room

Side Question: Can I rent out my entire flat/go overseas and let the MOP continue counting?

Ans: No.

PC users, highlight what's in the brackets

(Ok technically you can. Like everything else, just don't get caught la. If you want to take the risk to get your BTO, then happen to move overseas for like 2 years, be my guest by all means. Just make sure your friends don't bao toh you, and pray there won't be any HDB checks. Don't say I say one ok. Stay safe )

The reasoning behind MOP

To prevent people from abusing refinance/reprice policies, the Government has instilled the MOP so people won’t enter the BTO competition just to use it as an investment asset.

- If high net-worth individuals keep buying BTOs as an investment, how can a regular pleb like me ever move out of my parent’s house?

Why should I care about MOP?

Now comes the crux of this article, which is why YOU should take note of the MOP.

This is because after that 5 year minimum occupancy period, you may use that chance to sell your BTO to see if you made some money.

Wait wait wait ……. hol’ up ..

Now, first things first, I’m not telling you to sell your BTO immediately after your MOP ends.

I just want you to be aware of this concept.

The most basic, simple way to look at it is:

-

Your BTO will naturally rise in value - because it’s new + land for housing is scarce in S’pore

-

Depending on the location of your BTO, that will determine how high that value will reach, when that peak value will come and how long that will last.

-

MOP is important because your eligibility to sell must align with that peak period of profits.

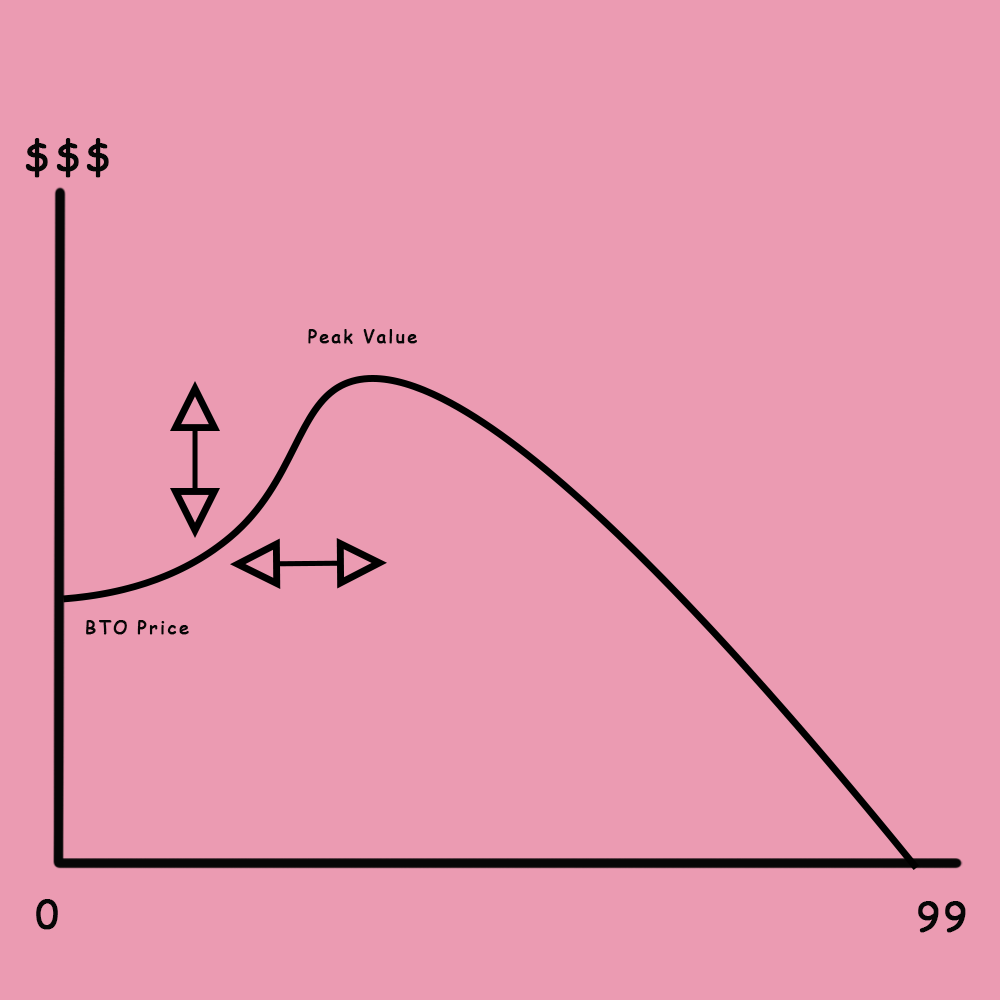

Disclaimer: To avoid spreading inaccurate information (and really, to save myself), this graph is what we project a 99-year BTO lifespan to be.

Who really knows what a 99 year BTO lifespan is supposed to look like? Singapore isn't even 99 years old LOL. The oldest HDB just turned 60 years old, and the oldest BTO is 15 years old.

"Common sense" tells us that a flat will depreciate in value simply because the value inches towards closer to 0 towards the later years, and people preferring newer flats. While there have been disputes to this, there's no hard evidence to it, so we'll just use the one that follows basic Economics for the time being.

While trying not to sound like I’m reliving my P6 oral days, the graph above depicts a standard lifespan of a BTO.

To recap,

At year 0, it starts at a lower-than-market-value-price because that’s how it’s designed to be. It’s cheaper than market value because more people can then afford it.

At year 99, the value becomes zer0 because the lease will expire and the flat returns to the Government.

The middle portion is the variable that will fluctuate, which determines whether you can earn $ or $$$ if you sell.

Ok heads up, the next section will be showing whatever I said above, and applying it to examples from this BTO (Bishan & Tengah).

It will start to get a lot more invest-y and analytical. If that's not your thing, or you don't intend to bid for Bishan/Tengah and you don't care, don't worry bout it.

Maybe read more about who mortgage brokers are and what they really do if you wanna?

For the rest of ya, buckle up.

Let me contextualize it by using examples from this BTO.

Obligatory Disclaimer again: Just in case a Karen wants to find me in 5 years time, everything written below is completely my own opinion. It's honestly just a way to get the reader to understand it clearer by using examples relating to them.

I'm not Nostradamus, but I'm open for consultations if you need numbers for Toto :-)

Let's start with Bishan.

| Rooms | Selling from (Excluding Grants) |

|---|---|

| 2-room Flexi | From $121,000 |

| 3-room | From $374,000 |

| 4-room | From $528,000 |

There are 2 main reasons why Bishan's BTO is priced towards the higher side.

- Bishan is a mature estate

- Since it's a mature estate, most of the housing plan for the area has already been completed, so there won't be any Bishan lots available for quite some time.

- High demand with low supply = Higher prices

So, imagine this new block of flats in a developed area with ready amenities.

Bro/sis, the value of the property confirm high one.

This is why the BTO lifespan for Bishan Ridges will look something like this.

![A graph showing the projected lifespan of Bishan Ridges![]()](https://mortgagemaster-files.s3.ap-southeast-1.amazonaws.com/files/Blog%20Images/Kyler%20Article%20Images/graph%20bishan%202.png)

From a selling perspective,

The value for this property is high right off the bat because like I mentioned, the area is already developed.

This means, after you clear the MOP in 5 years, you should already be seeing profit (even after the costs and repayment of CPF if you took that route)

I suspect there will be another spike, where the bold line meets the graph, because there are potential plans to expand Junction 8.

According to the URA Master Plan, J8 is set to expand into a mega-mall, with the bus interchange included. We're kinda expecting it to turn out like Northpoint City.

Just to show you the scale, this is J8 currently.

and this is what J8 is set to become (the black arrow indicates Bishan Ridges)

Right now, we're just unsure what is the exact year this will be completed, hence the "?" in the graph.

I suspect the price for Bishan Ridges to stay high (ow, ow) for quite some time too.

Bishan Ridges will stand out even more because most of the other blocks in Bishan will probably be reaching 50 years old by then.

It's just knowing that people prefer new houses rather than old houses.

It’s like when you’re shopping, you will also ask the staff if got new piece that's not on display right? ... (don’t need shy, I do the same)

The area X in the graph is just to show if the Government decides to implement any programs to renew the town of Bishan. For example, if they decided to upgrade the stadium, or they wanna erect an educational institution or something like that. If they do, it may prolong the decline.

Overall, I think it offers more flexibility for you because it's the fresh batch of blocks in an older estate. The value of Bishan Ridges will really only start to decline in about 40-ish years time, when the Goverment starts reclaiming the current HDBs at Bishan, then this will become the lao jiao.

Tl;dr for Bishan.

Peak price should be high, and should reach that level immediately once MOP ends. This BTO should stay in that 'profitable margin' for quite a period of time too. Glhf everyone.

Moving on to Tengah,

| Rooms | Selling from (Excluding Grants) |

|---|---|

| 2-room Flexi | From $108,000 |

| 3-room | From $194,000 |

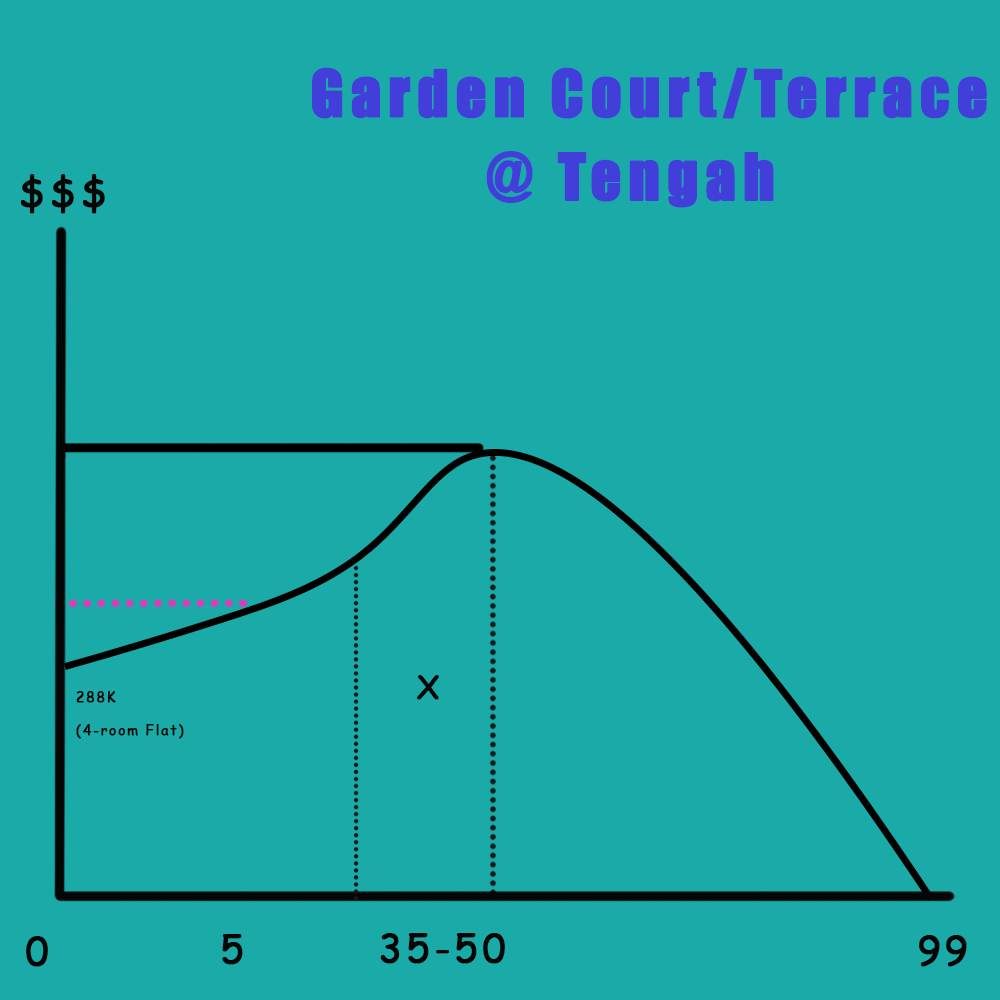

| 4-room | From $288,000 |

| 5-room | From $394,000 |

Garden Court/Terrace @ Tengah are much cheaper compared to Bishan Ridges because it's a non-mature estate. Not only is it a new town, but it’s a very, very, very new town.

New to the extent where there’s absolutely nothing there right now.

It's why there are alot of (expected year) and (future) in the infographic above.

But gurrrrrrl, don't be sleepin on Tengah. The glo'up master plan is set up to be quite insane.

Transport will start kicking in from 2026, and will be fully completed by 2028.

Tengah is also set to be Singapore’s “Forest Town”, with a heavy emphasis on being green and environmentally-driven.

And it's ironic that I used ‘driven’ because Tengah is designed to be a Car-Lite society, having an sub-ground level road for cars, so that there is more space on ground level to promote walking, cycling and other activities.

Furthermore, Tengah is set to be a cooler town by increasing ventilation and encouraging better wind flows by the UM-MIST (Urban Microclimate Multi-Physics Integrated Simulation) software.

Having said this, this is what the lifespan for the Tengah BTO should look like.

From a selling perspective,

This is more complicated than Bishan because it's unproven. Everybody knows Bishan is a heartland, but for Tengah, only time will tell if you will heart this land.

What we know for sure is that

- There is demand for flats in Tengah, because it was oversubcribed.

- Also, The Goverment has stated that it'll first wait for most of the units to be resided in before all these features gets really implemented.

Following the expected completion date of 2024, this means the earliest MOP clearance is 2029.

By then, most of the amenities should have been completed. The 3 MRT stations surrounding Garden Terrace/Court is set to finish by 2027. The URA Master Plan has also set aside 3 areas for educational instituitions, but right now we have no clue on what type of school it is.

Assuming all these projects follow their schedules, there's really no reason why the value of your property shouldn't be high immediately. However, whether this will be peak or not, I highly doubt so.

This is because there are a lot of comparisons with Punggol, which was the last town built before Tengah. And if Punggol's property prices are to be followed, the peak value will only be attained after some time.

For the area of Punggol, the current record for highest property sold happened about 17 years (2019) after it's very first BTO launch (2002).

Using this correlation, this would be around 2035 for Tengah.

The duration of Tengah being 'profitable enough' is hard to accurately predict too due to it's unknowing nature.

Sure ... it's new, it has futuristic and environmentally-friendly features, and travelling to business districts has been alleviated now that more companies are shifting to Jurong

If we were to use Punggol as a reference (because it's rly the closest example), prices have been profitable over the last 12 years as compared to the initial purchase. While Punggol is still set to have its Punggol Digital District built in 2023, Tengah has it's Jurong Innovation District as well. Only time will tell how far and long these districts will carry the towns to become money-making estates.

Overall, from an investment POV, Tengah is ultimately "less rewarding now" than Bishan because it's still under development. However, the capital needed for a Tengah flat is much lower than Bishan, so it's still proportionate in that sense.

With the current outlook on sustainable and green methods being more receptive, especially with the younger generation, who conincidentally makes up a majority of the BTO candidates, Tengah might be really attractive with the younger audience, and may continue to be with the future generations.

Plus c'mon la, this BTO sitting in the center of 3 different MRT stations.

That's maximus convenience. This feature itself will likely be the long-lasting value factor.

The potential for Tengah is really high (just imagine Punggol last time vs now), and as time passes, Tengah itself will become a mature estate. I personally think that this is the period prices will really start to soar. Even after the MOP and JID, area X is the one to look out for to see if Tengah really starts to resonate with the general public, and whether there is a big enough demand for it in 35-50 years time.

Regardless of whether Tengah was your last option and you want to sell after MOP, or only selling it after it has matured enough, one thing seems to be relatively certain, you will make money.

Tl;dr for Tengah.

Personally think peak price might only reach in 30 years time (at least), once everything is settled and it slowly develops into a mature town. The risk is that you'll have to wait that long. Short-term speaking, I still think Tengah will make a buck for you. This one lagi glhf everyone.

Eh, I thought y'all Mortgage Master, not Investment Master?

A reason why I didn't include any prices on the graphs (eg. how high the price can get to) is because I'm not a property agent LOL.

What I can do for you however, is to give you a general idea of the trend, and advice how you can better prepare beforehand.

If you're keen on taking this route (like I said, it's not for everybody), a major thing you need to prep in advance is your lock-in period in your loans.

Let me put this into perspective,

You sign up for Bishan BTO. Completion is 2026, so you sign a mortgage loan in 2026.

Typical lock-in rates for mortgage loans range from 2-3 years.

Since the MOP is 5 years, you should ideally get a loan with a 3-year lock in period, then refinance into another loan that has a 2-year lock in period.

This then allows you to not be in any lock-in period for your loans, while simultaneously clearing your MOP. If prices go according to what we discussed earlier, this one really swee swee bo zao zui

And gee .. I wonder who can help you with planning and choosing mortgage loans.

Ultimately, I just want to reiterate that this isn't to convince you to sell your BTO after 5 years. (The very reason why we only published this towards the end of BTO).

Rather, it's just an aspect you could, and should, consider because your house is ultimately an asset you could use for profit in the future.

If you've made your your mind up and submitted your bid, congratulations! I'm very happy for you and I wish you all the best.

For those who have not, do take just a little bit of time to consider this. BTOs aren't first-come-first-serve anyway. If you intend to have a more money-oriented perspective of your BTO, there's no need to rush if you can afford the wait. A little planning could help in the long run.

Till next time, don't litter and be good people.

Also apologies if this popped up for people actually searching for mopping services for HDB