The Monetary Authority of Singapore (MAS) publishes its Macroeconomic Review twice a year in conjunction with the Monetary Policy Statement release. This review includes an analysis and assessment of Singapore’s economy that will help MAS to decide on its monetary policy decisions.

In the latest macroeconomic review, MAS had a special segment from the Ministry of National Development highlighting Singapore’s rental market. In this 5-minute article, we’re here to help you digest every key need-to-know highlight from MAS’ macroeconomic review.

Construction Delay And Lifting Of Border Restrictions Drove Hot Rental Market

A cursory glance at the rental index of private property show startling increases.

Index of Private Restidential Properties

Source: URA

Source: URA

In the macroeconomic review, the rental index of public property mirrors that of private property.

Interestingly, data shows that rental costs remained relatively stable in the years preceding COVID-19. Now, post-COVID, both public and private housing rental index have shot up within the span of three years.

There are a couple of factors that MAS attributes to the hot rental market in Singapore.

The first factor is the construction delays resulting from COVID-19. Because of the delay in the construction of new homes, it led to a “one-off” demand from both citizens and permanent residents looking for temporary accommodation to settle into until their homes are completed; leading to a surge in demand for rental units.

Another factor was the lifting of border restrictions. The lift led to an inflow of foreigners moving back into Singapore for employment. This drove non-resident rental demand higher across public and private residential units.

How Does Rental Market Look In The Next 6 Months?

Singapore’s rental market has been heating up over the last six months with rents growing significantly. This led to various reports and forecasts that the rental market is set to grow another 10-15% in 2023 alone.

According to MAS, they think that the next six months will be a period where rental rates will start to moderate. While this does not necessarily mean that rental rates will go down, it does indicate that any growth in rental prices is likely to be slower compared to first half of 2023.

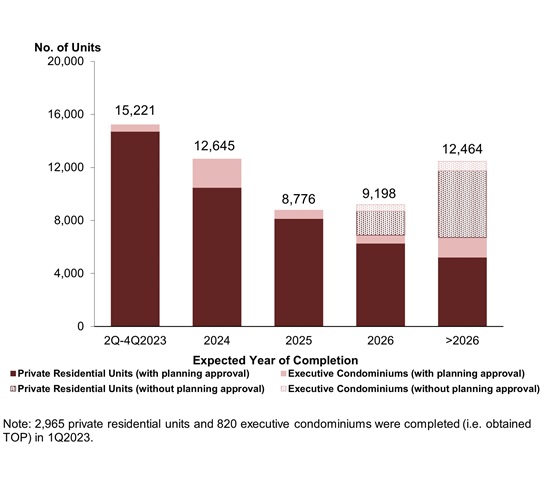

Pipeline supply of private residential units and ECs by expected year of completion

Source:URA

Source:URA

The reason behind MAS’ forecast is mainly driven by higher incoming supply in 2023. Based on projected figures by Ministry of National Development (MND), about 100,000 residential units will be completed between 2023 and 2025.

A total of 3,785 private residential units (including ECs) were completed in 1st Quarter 2023, with 15,221 more units expected in the rest of the year. 23,000 HDB flat units are in the supply pipline for this year, adding up to about 42,000 private and public residential units altogether. And as new housing is completed, we can expect existing tenants to move out of their rental unit into their permanent home. This will help to ease the supply imbalance that drove up the rental rates.

Inflation Will Still Stay High For Awhile

Even as rental rates ease off, MAS predicts that inflation will continue to stay high.

One of the factors behind inflation is the cost of shelter. Both rental rates and cost of home ownership are part of the Consumer Price Index (CPI), which is used to calculate the Inflation Index. Even though growth in rental rates will slow down over the next six months, the effect of high rental rates growth will still be felt in the CPI. Accommodation inflation will take time to ease off on the inflation index.

Moreover, home prices have yet to come down. The cost of financing is also the highest in the last decade.

Long-Term Driver For Property Valuation Is Still Healthy

In a society where the majority are homeowners, the fact that property valuation is going up should be positive news for us. However, the question is whether it is sustainable. Nobody wants a situation where the property market enters a bubble and bursts, causing pain for all of us.

In its macroeconomic review, MAS believes that the long-term driver for Singapore’s property market is still healthy. At the core of it, residents wage growth will continue to stay above historical average despite easing. Positive growth in residents wage will be the underlying support for the long term growth of property valuation in Singapore’s property market.

How Do You Keep Your Property Affordable?

A key takeaway for us from MAS macroeconomic review is that property prices will continue to trend upwards. While the growth will be more sustainable and backed by fundamental growth in resident wages, homebuyers need to be prepared for the scenario that homes will eventually become more expensive.

As a homebuyer, you need to make full use of strategies to help you keep your home affordable. For example, you might want to consider staying in a less expensive estate (e.g. non-mature estate). You might also want to take a closer look at how you finance your home.

Some strategies that you can use to reduce your mortgage cost might just include the option of engaging a mortgage broker. A mortgage broker will give you timely reminders when it is time to refinance your loan so that you don’t pay unnecessary interest charges to the bank. At the same time, they can help you broker the best mortgage deal, based on the existing market conditions.

At Mortgage Master, we know the latest home loan packages in the market and can sometimes offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.