You’ve finally picked your dream home, already filled your Taobao wishlist with all your preferred home décor items, and yes, also chosen the person, or cat, or cats (we’re not judging) you want to spend your lifetime with.

Now that you’ve made all the difficult decisions, all you have to do is just choose the right home loan package. What could go wrong? After all it’s only…

...the biggest financial commitment you’ll ever make in your life.

Not to worry, here are the 7 steps you need to ensure you choose the right home loan package in Singapore. Make sure you read all 7 before you start your home loan process.

1. Research all the home loan packages currently being offered by the banks

You don’t know what you don’t know. The first step to any loan comparison is to make sure you have all your options laid out side by side. That means finding out every single home loan package that banks and financial institutions are currently offering.

There are 16 banks and financial institutions in Singapore that offer home loan packages. Each will offer 2 to 3 different packages that you can qualify for, so expect to compare between 30 options altogether.

Make sure your information isn’t outdated!

To remain competitive, banks will change their offerings on a whim, so make sure the packages you’re comparing are still available.

2. Discard the packages that you obviously shouldn’t be taking up

While no home loan decision is ever easy, there are some options that are just not worth your time, such as board rates. These are the packages that you immediately know to swipe left on.

Board rates are home loan interest rates that are completely controlled by the bank with limited transparency as to their volatility. No matter how enticing a board rate is (and some are extremely tempting because they want to be competitive), just say no.

Choosing a board rate is like playing 50 Shades of Grey with your bank – you never know what you’re in for, but it almost, always hurts.

Read more about board rates and what they mean

3. Fixed deposit-linked rates? Handle with care

First introduced in 2014, fixed deposit-linked rates are home loan packages that are pegged to the banks’ fixed deposit interest rates. They’re more transparent and less volatile than most other packages, making them immensely popular at launch because we all assumed (yes, me included!) that the rate would still rise and fall like a typical home loan package.

However, for 5 long years, fixed deposit-linked rates refused to fall, stubbornly staying high even as the US Fed Rate, SORA, SIBOR, and any hope of overseas holidays dissolved away at the start of the horror blockbuster that was 2020. It was an utter betrayal. Fixed deposit-linked rates was supposed to bring balance to the Force, not leave it in darkness.

It was only in May 2020, 3 whole months (an entirety in the mortgage world) after the freefall of SIBOR, that fixed deposit-linked rates finally dropped for the FIRST time.

Think of fixed deposit-linked rates as the imposters in Among Us. Most of the time they seem harmless, appearing to work with you and help you finish tasks but let down your guard and OH NO

And unlike the game, you won’t have somebody calling an emergency meeting or reporting a body, because well, you should’ve known the risks of taking up a fixed deposit-linked rate.

4. How do you choose between floating and fixed rates?

Okay so you’ve discarded board rates, you’re side-eyeing fixed deposit-linked rates, which means you’re left to choose between floating and fixed rates.

This is essentially a choice between the transparency that floating rates offer, and the security of fixed rates. Floating rates are traditionally lower than fixed rates, but are volatile, which means your monthly repayment may change several times throughout the year. Fixed rates ensure your monthly repayment is consistent, but you must pay a premium for that reassurance.

Interest rates have started rising, and we expect SORA-linked floating rates to increase now that the US Fed has planned several rate hikes in 2022.

If you cannot live with that kind of risk, no matter how small, then ignore SORA floating rates and stick to fixed rates, even though they're significantly higher now.

Learn more about choosing floating rates and fixed rates in Singapore.

5. Learn the cheat code to home loan rates

At this stage is where you find the real insights from our veteran mortgage consultants at Mortgage Master.

When you’ve been in the industry as long as we have, you notice discernible patterns of home loan rates. For example, at any point in time, most home loan rates in Singapore will hover between 1.3% and 2.2%. This means that most homeowners can expect to pay 1.6% to 1.8% on average across their entire loan tenure.

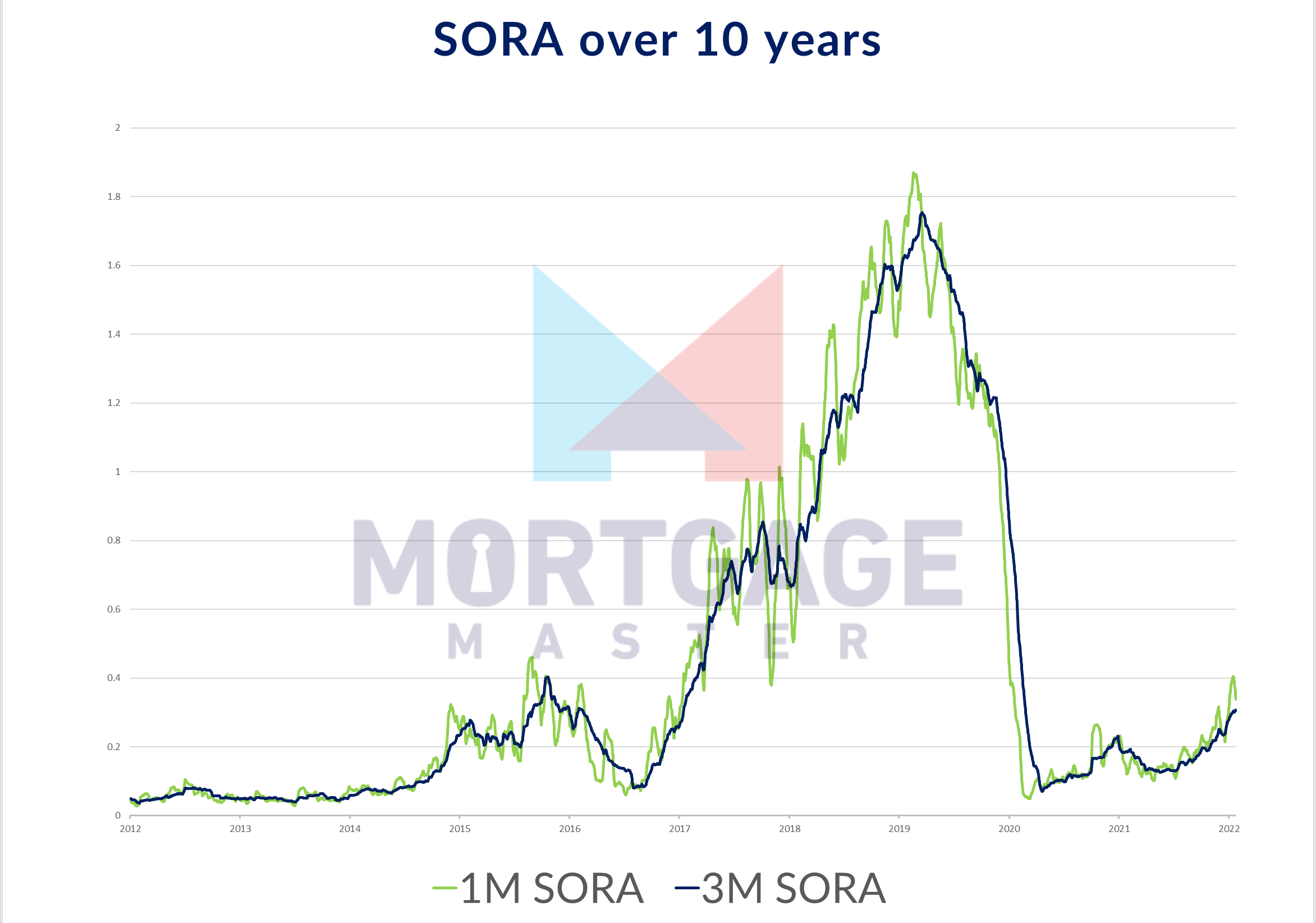

Even though home loan packages linked to SORA rates are relatively new, SORA has been tracked for years. Currently the SORA 10-year average is 0.43 for both 3-month SORA, and 1-month SORA.

Things get even more dramatic when you consider the SORA 20-year average. 3M SORA rose as high as 3.29 in January 2007, which means that the 20-year average is 0.70 for 3M SORA and 0.71 for 1M SORA.

What does this mean for you? Now that you know that most home loan packages average around 1.6% to 1.8%, and that 1M SORA and 3M SORA can average at 0.70 over the entire loan tenure, you can make an educated choice of which package is best for you.

For example, a fixed rate home loan package currently being offered is 2.25% over 2 years. This rate is higher than 1.8%, so only go for it if you truly value the short-term security it brings.

If you prefer a floating rate, pay attention to the spread. 3M SORA + 0.80% might look like a good rate now while 3M SORA is 0.30 but remember that the 3M SORA 20-year average is 0.70. This means you can expect to pay an average of 1.50%, making a 0.80% spread a good opportunity while still available, since it keeps your home loan interest below 1.6%.

So, TL;DR? If you find a home loan package that can stay within 1.6% to 1.8%, you’re safe. If it exceeds this range, consider another option.

6. What happens when none of the packages being offered meet these criteria?

Banks love to offer the most competitive products, so what happens if none of the available packages can ensure you stay within the 1.6% to 1.8% criteria? You can be sure that banks will be coming up with a home loan package that does very soon.

Usually, it’s worth waiting for such a package to be launched. But even if you’ve been in the industry as long as we have, we cannot say for sure how long that waiting period will be, since it’s all up to the banks and their own internal yearly and quarterly goals.

7. So, is it worth waiting for the best home loan package?

There will always be a group of homeowners who perpetually seem convinced that rates can and will drop lower… someday. And then when it finally does, they will refinance and be able to start saving money.

In the meantime, however, they are bleeding money by holding on to a home loan interest rate that is much higher than any product in the market today.

For example, let’s imagine Aisha and Priya both have an outstanding $350,000 home loan which is currently on a 2.6% interest rate. They’re both paying $1,871.76 each month. Aisha wants to refinance now to a 1.5% interest rate, while Priya is waiting for banks to offer a 1.0% interest rate.

After refinancing, Aisha now pays $1,688.91, saving $182.85 each month. After 12 months, she has saved $2,194.20 more than Priya. Priya finally refinances to a 1.0% package and starts paying $1,621.03 each month.

| Aisha | Priya | |||

|---|---|---|---|---|

| Month 1 | $1,689 per month | $1,689 (total) | $1,872 per month | $1,872 (total) |

| Month 2 | $1,689 per month | $3,378 (total) | $1,872 per month | $3,744 (total) |

| . . . | . . . | . . . | ||

| Month 12 | $1,689 per month | $20,267 (total) | $1,872 per month | $22,461 (total) |

| Month 13 | $1,689 per month | $21,956 (total) | $1,621 per month | $24,082 (total) |

After 24 months, Aisha would have paid a total of $28,000, while Priya would have paid a total of $28,442. Priya is still paying more overall!

| Aisha | Priya | |||

|---|---|---|---|---|

| Month 23 | $1,689 per month | $38,845 (total) | $1,621 per month | $40,292 (total) |

| Month 24 | $1,689 per month | $40,534 (total) | $1,621 per month | $41,913 (total) |

| . . . | . . . | . . . | ||

| Month 44 | $1,689 per month | $74,312 (total) | $1,621 per month | $74,334 (total) |

| Month 45 | $1,689 per month | $76,001 (total) | $1,621 per month | $75,955 (total) |

After 45 months, Aisha would have paid a total of $76,001, while Priya would have paid a total of $75,955. Priya finally pays less than Aisha in total!

Because she waited 12 months before refinancing, it will take Priya almost 4 years before she finally saves more than Aisha overall. During that time, Aisha may have found a lower interest rate and refinanced again!

(DISCLAIMER: For those that feel this is an extreme scenario - the point is you can never predict with pinpoint accuracy when rates will next fall, and any delay in refinancing means less savings in the long run.)

7 steps on an exceptionally important journey

Becoming a homeowner is no small achievement and you should be proud of the accomplishment. But just because you'ce achieved that on your own doesn't mean you have to take these 7 steps alone! Use Mortgage Master's free mortgage consultancy service to go through these 7 steps with an experienced industry expert that you can trust and has your best interests at heart.

As an established mortgage broker, Mortgage Master already has all the best home loan interest rates offered by the banks and financial institutions at our fingertips. But more importantly, we listen to you, our customer and ensure that our advice is personalised to your needs and financial situation. Whether you're worried about cashflow in the long run, or plan to sell your property in a few years, we'll recommend the best home loan package for you. Best of all, our no obligation services are free!

So give us a call today, drop us a WhatsApp message or fill up our enquiry form and let us help you confidently make this important decision in your life.