As we come to the end of 2023, many homeowners are still grappling with rising interest rates as their new normal. Many of us have never experienced what it’s like to be financing a home under such conditions. As such, you may be at a lost on how to deal with this new normal.

Thankfully, we’ve got your back covered. Here are four fundamental tips that will help you financially adapt to an era of the increasing costs of borrowing and still keep your home ownership affordable.

1. Make Use Of Rental Income

If you are feeling some financial pressure from rising interest rates on your bank loan, the natural solution is to raise your income. But that’s easier said than done, especially with the threat of recession always around the corner. Some of us are just praying that our jobs are not on the line, let alone gun for that implausible pay increment.

Luckily for existing homeowners, there’s an alternative source of income that you can tap on: Rental income. If you have a spare room in your home, why not rent it out? Renting out a spare room can help you make passive income of $800-$1,000 every month. Even with an increasingly expensive monthly mortgage repayment, this should help to cover 30-50% of it and give you more disposable income to spend.

2. Make Partial Principal Repayment

Did you know that the amount that you are paying to your bank every month for your mortgage is made up of two components? There’s the principal component and interest component.

The interest component is the interest that is charged by the bank when you take out a loan with them. It is calculated by taking the monthly interest rate on your bank loan and then multiplying it against the outstanding principal amount that you owe to the bank for the month. This is known as loan amortization.

If you want to reduce the repayment amount that you have to make every month, just simply do a partial repayment. A partial repayment means that pay off a chunk of the principal amount that you owe to the bank. This will reduce the outstanding principal amount, which translates to less interest charges on your bank loan.

Let’s illustrate this with a simple example. Imagine that you owe your friend $100,000. Your friend tells you that they will add 1% of what you owe at the end of the month as interest. This means that at the end of next month, you are going to owe them $101,000.

Now, let’s say you won the lottery and you told your friend that you’ll pay off half your debt, $50,000. This means that at the end of every month, they will only charge $500 in interest (instead of $1,000) to what you owe. This ultimately translates to a lower monthly payments from you to your friend to clear what you owe.

3. Lengthen The Tenure On Your Bank Loan

Let’s admit it. Not every one of us has a lump sum of money that’s just lying around, waiting for us to make a partial principal repayment. And if that’s the situation that you are in, fret not. There are still ways that you can reduce your monthly mortgage repayment.

For starters, you can lengthen the tenure of your bank loan. The logic for this is simple. Say you owe your friend $100,000 and your friend has told you that you have to pay them back over 10 months. This means your monthly repayment is $10,000. However, if you asked your friend whether you can pay them back over 50 months instead, then the monthly repayment amount drops to $2,000.

Of course, there are some downsides to this. After all, the bank isn’t your friend. If you lengthen the tenure of your bank loan, they are going to continue charging you interest for as long as the loan is not fully paid up. The longer you drag your bank loan, the more interest you end up paying.

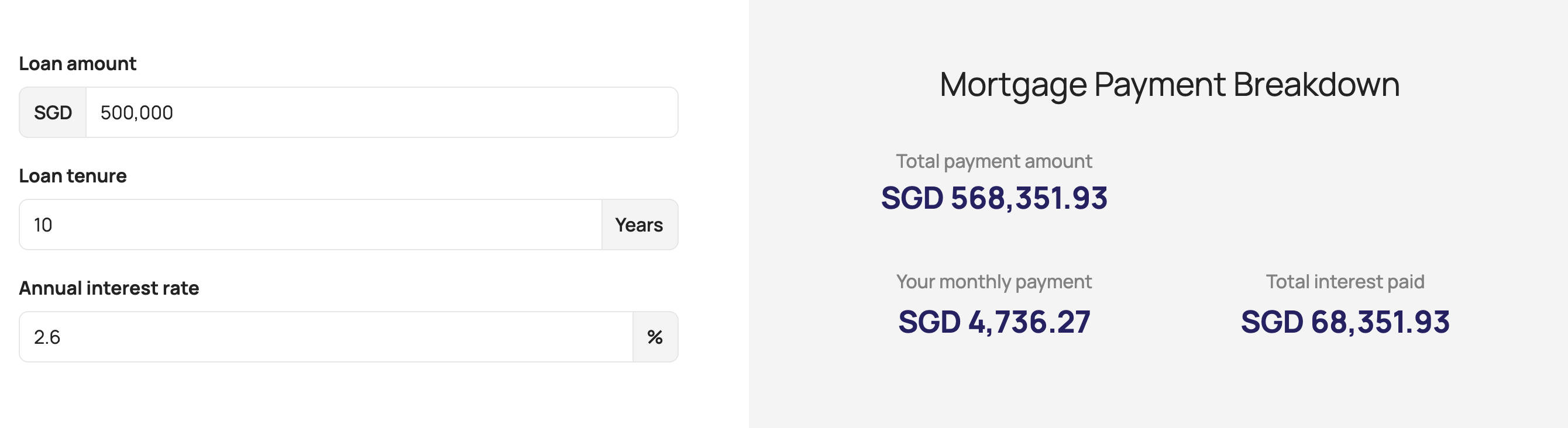

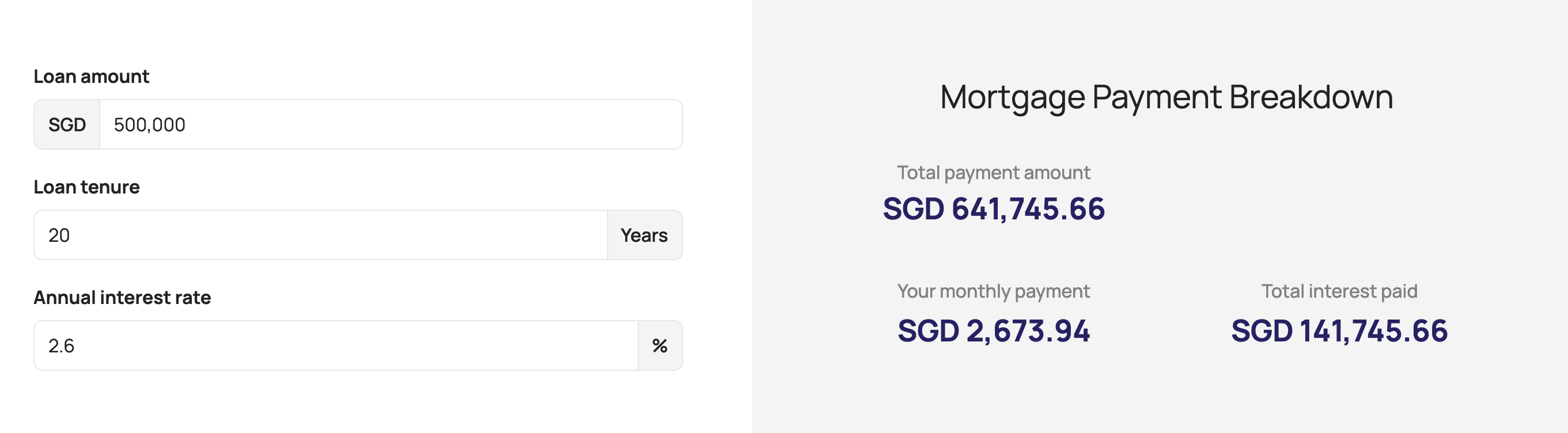

Source: Mortgage Calculator

From the calculator screenshots above, you can see that the total interest you end up paying more than doubles if you lengthen the loan tenure from 10 years to 20 years.

If you want to calibrate and see what’s a suitable tenure length to lengthen your bank loan, you can use Mortgage Master’s mortgage calculator.

4. Refinance With A Better Bank Loan Deal

If you don’t want to rugi and pay unnecessary interest payment on your bank loan, here’s an alternative that you can consider.

Instead of lengthening your bank loan tenure, lowering the interest rate that you are paying on your bank loan will also help to reduce your monthly mortgage repayment.

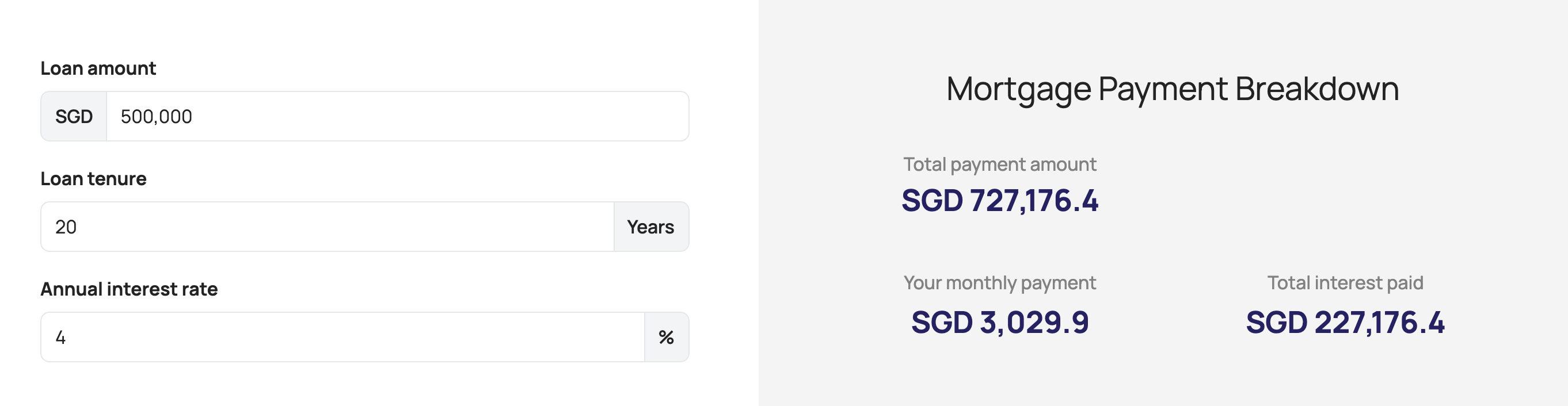

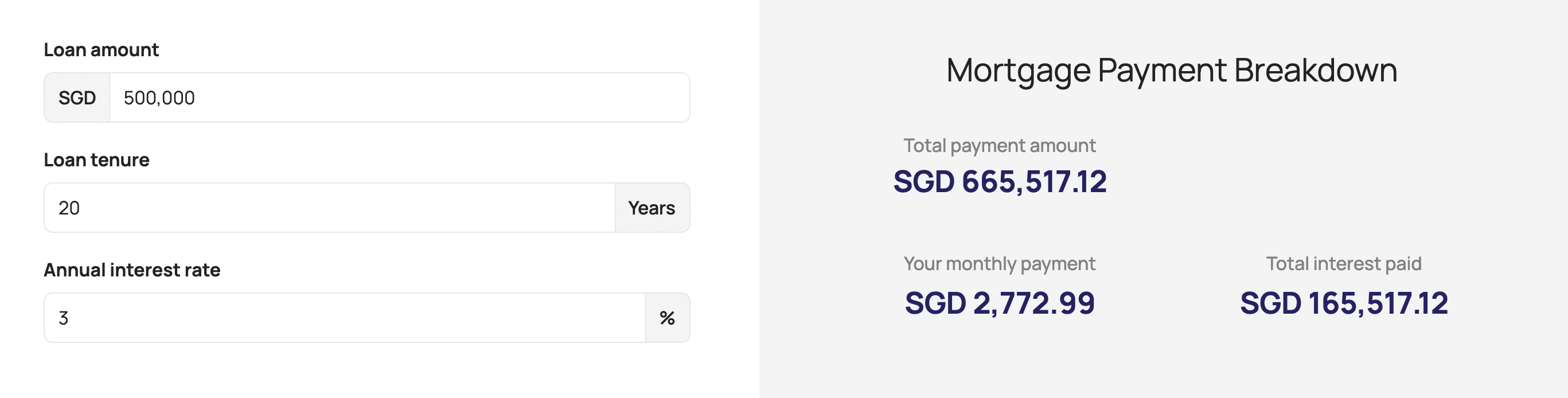

For example, if you find a deal to lower your interest rate from 4% to 3%, it will save you $250 every month. Not just that, the total interest that you will pay in the lifetime of your bank loan will also drop by $62k.

Source: Mortgage Calculator

That’s a pretty sizeable saving for an action that might seem small. And the best part? You can get someone to help you with all the impending searches and paperwork!

At Mortgage Master, we know the latest home loan packages in the market and can sometimes even offer exclusive interest rate packages that you can’t get directly from the bank. If you're looking for a better bank loan, fill up our enquiry form and our mortgage consultants will follow up with a call.